- The J Curve

- Posts

- The Health Insurance Company That Thinks Like a Tech Startup

The Health Insurance Company That Thinks Like a Tech Startup

Most health insurance companies are black boxes—customers pay monthly premiums and pray their claims get approved.

Sami flipped that model. They're the first Brazilian health insurer to bundle gym memberships with health plans, proving exercise delivers 5:1 ROI on medical costs, while using AI to automate everything from fraud detection to clinical workflows.

This week, I sat down with Dr. Vitor Asseituno—physician turned serial entrepreneur, founder of Sami—to unpack what it takes to build a tech-enabled health insurance company from scratch in São Paulo, scale to 20,000 customers, and achieve 53% loss ratios that traditional insurers say are impossible.

We covered the contrarian thesis behind starting with SMBs, why distribution beats product every time, and how pipeline thinking solves the three hardest problems in business: selling, hiring, and fundraising.

Let's get into it.

FROM PETER DRUCKER AT 10 TO MEDICAL SCHOOL BY ACCIDENT

Olga Maslikhova: You're a trained physician who ended up founding a health insurance company. Most doctors become specialists, not entrepreneurs. What nudged you toward building businesses instead of practicing medicine?

Vitor Asseituno: It actually started when I was 10 years old, reading management magazines at my mom's friend's house. She was an HR executive, and when I got bored watching TV, I'd flip through Harvard Business Review and McKinsey Quarterly. I was reading Peter Drucker and Jack Welch as a teenager—before anyone recommended them to me in business school.

I went to medical school almost by accident. I applied to engineering everywhere, but one university only offered medicine. A friend challenged me, said I'd never pass the medical entrance exam. So I took it—and got in.

But by my second year, I was already starting what Brazilians call a "junior company"—basically a student consultancy. By year four, I knew I had to build something real before graduating.

SAN FRANCISCO, OBAMACARE & ROCK HEALTH

OM: You spent time at Rock Health in San Francisco during a pretty interesting period—Obamacare, digital health explosion, meaningful use requirements. How did that shape your thinking about healthcare and technology?

VA: That month changed everything. It was 2012, peak digital health boom. Obama had just spent $36 billion pushing providers to adopt EMRs—not just buy them, but use them meaningfully. Silicon Valley was suddenly paying attention to healthcare.

Halle Tecco was building Rock Health as 'Y Combinator for healthcare.' She'd worked at Apple approving health apps in the App Store, and her husband worked at Cloudera, a big data company. I was an intern giving out badges at demo day, but I was meeting every healthcare VC in the Valley.

When I came back to Brazil, I thought: why isn't this happening here? Brazil is the second-largest healthcare market globally, growing faster than the US because of medical inflation. But nobody was applying tech to solve it.

OM: You could have stayed in Silicon Valley and built there. Why come back to Brazil?

VA: I'm obsessed with ecosystem building. Instead of building one company, I wanted to build the infrastructure that supports 40 companies. Brazil felt like this massive, underserved opportunity. All the big tech companies were treating it as their second market—Facebook, Twitter, Google. But healthcare? Nobody was thinking systematically about it.

Plus, there was already a Rock Health in the Bay Area. Why not build Rock Health for Brazil?

THE FOUR LESSONS FROM SELLING TO A $3B COMPANY

OM: Before Sami, you built and sold an events business to Informa Group, a £3 billion revenue company listed on the London Stock Exchange. What did that experience teach you about picking your next venture?

VA: Four critical lessons that directly shaped Sami's thesis:

First, market size. The events business had great margins but tiny TAM. General Atlantic did research showing market size is the biggest predictor of success. You're never going to outgrow your market. In healthcare, insurance is the biggest possible market—bigger than labs, pharma, or hospitals.

Second, recurring revenue. Events meant selling sponsorships to the same people every year, finding new stories to justify renewals. Health insurance gives you thousands of contracts paying monthly. The present and future become predictable.

Third, sell something people already understand. I watched hundreds of health tech startups struggle to explain "AI on the cloud with crypto" to buyers. We sell health insurance. 50 million Brazilians buy it every year. I don't have to educate the market on why you need it—just why ours is better.

Fourth, avoid death by pilots. Too many startups waste years doing free pilots for incumbents, only to get squeezed on price and equity. We decided to be the payer—the mothership. We pay everyone in the value chain, so we control the relationship.

Vitor Asseituno and I at our Studio in Sao Paulo

THE SMB BET: BLUE OCEAN WITHIN A BLUE OCEAN

OM: You started with SMBs and individual entrepreneurs—not the obvious choice for most insurance companies. Why?

VA: Enterprise sales cycles are brutal. Two-year decisions, HR directors who won't risk their careers on a startup, global brokers demanding nationwide networks we couldn't build. Plus, big companies negotiate everything down—your margins disappear.

SMBs were the opposite. Underserved by incumbents, shorter sales cycles, higher margins because they pay full price. And here's the key insight: we discovered nobody was selling one-life policies to individual entrepreneurs.

The regulation changed in 2018—suddenly 10 million "MEIs" (individual entrepreneurs) could buy business plans instead of individual plans. But no one was serving them. It was a blue ocean within a blue ocean.

DISTRIBUTION IS EVERYTHING

OM: Distribution seems to be your obsession. You've said it's the most overlooked part of building a business.

VA: Completely. Everyone focuses on building the best product, the coolest AI, the most innovative features. But if you can't sell it, none of that matters.

We started selling direct, but eventually realized we needed brokers. People told us to avoid them—"they're hard to work with." But now brokers represent over 50% of our new sales every month.

The beautiful thing about brokers? You only pay when they sell. Your customer acquisition cost is always tied to revenue. Compare that to hiring a sales team and paying salaries whether they hit quota or not.

THE PIPELINE THEORY: SALES, HIRING & FUNDRAISING

OM: Let's talk about your "pipeline theory." You've applied it to sales, hiring, and fundraising.

VA: Sales, hiring, and raising capital—these are the three hardest parts of building a business. And they all solve the same way: pipeline.

My partner taught me this early on. He said, "One sale makes you a hero. Hitting quota every month is pipeline." It's pure math. If your conversion rate is 10% and you need 10 customers, you need 100 conversations.

Same with hiring. Want a great CFO? Talk to 50 candidates. One will say yes, even by mistake.

Same with fundraising. Our last round, we talked to 108 investors in 90 days. We have an internal rule: we don't give up before getting 100 nos. Because we don't count unanswered emails—only official rejections.

OM: That's an incredible volume. Most founders burn out after 20 rejections.

VA: My wife helped calibrate that expectation. After our 15th no from a seed round, I came home discouraged. She asked, "What's the number?" I said, "What number?" She said, "How many nos do you need before you give up?" I remembered reading it's usually 40 minimum. She said, "Then keep going."

Sometimes you need more. If conversion rates drop from 3% to 1%, you need a bigger pipeline. It's mathematical.

WATCH OR LISTEN TO THE J CURVE EPISODE WITH VITOR ON SPOTIFY:

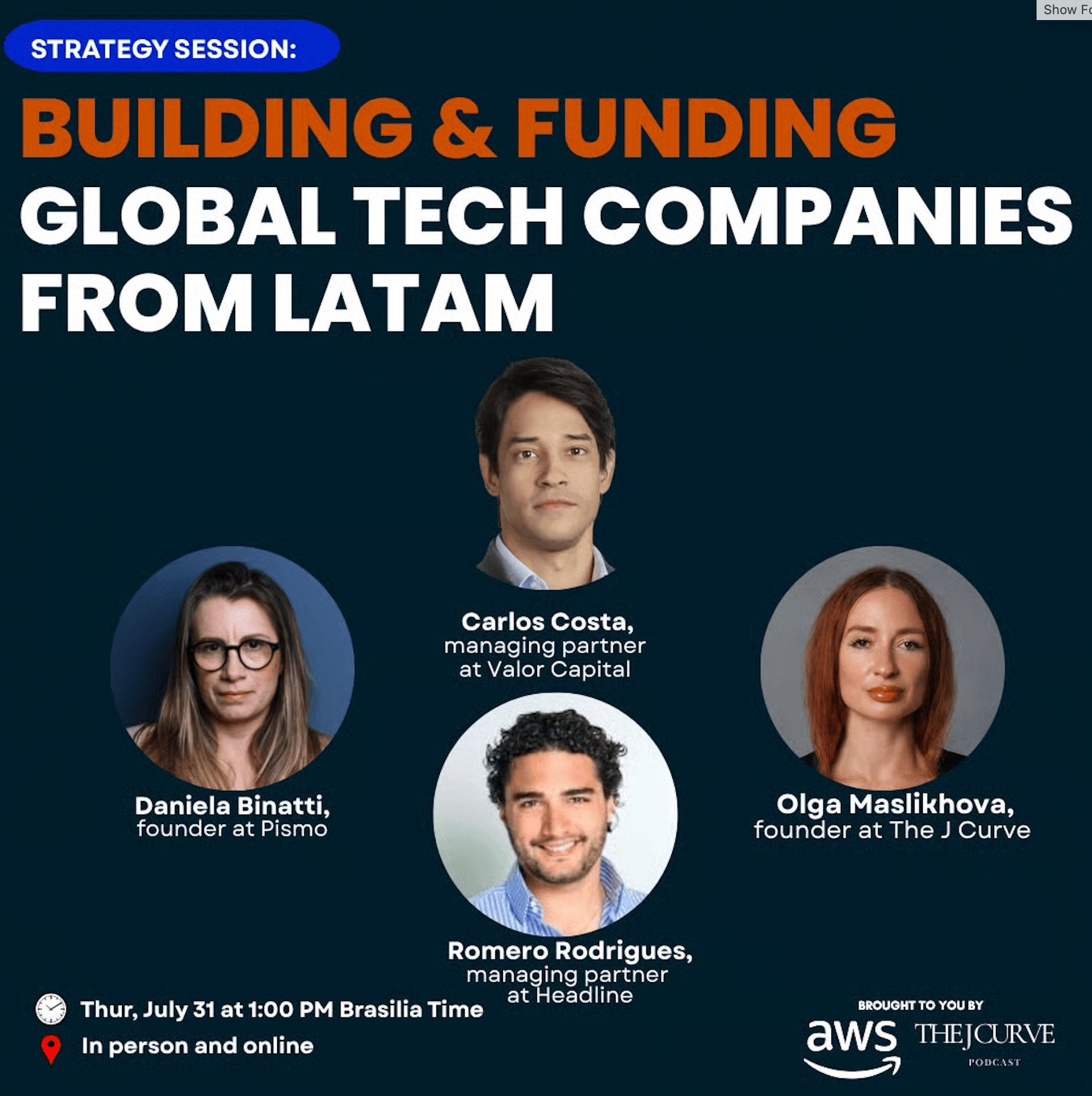

And if you’re a founder building from Latin America with global ambition, don’t miss our upcoming strategy session with AWS on how to scale beyond borders. We’ll go deep on what changes when you start selling, hiring, and fundraising internationally — and how to position your company for breakout success.

Join us live in São Paulo → RSVP here

Or tune in virtually → Sign up for the livestream

AI WORKFLOWS THAT ACTUALLY WORK

OM: Let's talk about AI. You're using it across underwriting, claims, and fraud detection. What kind of impact are you seeing?

VA: The numbers are dramatic. We've developed ambient listening for telemedicine—AI generates clinical summaries and fills EMRs automatically. That alone saves us $800 per month per physician in administrative costs.

But the bigger story is risk selection and loss ratios. Our first cohorts had 85% loss ratios—terrible. Second year, 69%. Third year, 53%. Fourth year cohorts are even better.

53% is unheard of in healthcare. We've tripled our gross margin this quarter compared to last year, and that's a combination of better underwriting, AI-powered fraud detection, and operational efficiency.

THE GYM MEMBERSHIP BREAKTHROUGH

OM: You were one of the first insurers to bundle gym memberships with health plans. That seems obvious in hindsight, but it wasn't at the time.

VA: The insight came from our partnership with Wellhub (formerly Gympass). We were the first health insurer to offer gym access as a core benefit.

Everyone knows exercise makes you healthier, but no one had proven the ROI for insurance. We now have real data: for every dollar we spend on gym access, we save $5 in medical claims.

The key is we have actual usage data—every time you check into the gym—cross-referenced with every medical expense we pay. Traditional insurers rely on surveys where people lie about their exercise habits. We have ground truth.

Plus, it's a retention tool. If you're switching to a competitor that doesn't offer CrossFit, you'll think twice.

PRICING RISK, NOT EXCLUDING PEOPLE

OM: Your loss ratios improving over time suggests you're getting better at picking who to insure. How do you think about risk selection without it becoming discriminatory?

VA: It's about pricing risk correctly, not excluding people. We use all available data—not just health history, but behavioral patterns, engagement with preventive care, exercise habits.

But here's what's interesting: the healthy people who exercise stay with us longer because competitors don't offer the same benefits. So we're not cherry-picking—we're creating an environment that attracts and retains people who care about their health.

THE PARTNER MATTERS MORE THAN THE FUND

OM: You've raised substantial rounds from top-tier VCs, but you've said the partner on your board matters more than the fund brand. Why?

VA: Because 90% of your fund experience comes from the one person sitting on your board. Funds are small teams—5 to 25 people. You interact with one partner most of the time.

I've seen entrepreneurs have completely different experiences with the same fund based on which partner they work with. The partner's personal motivation matters: Do they have family in healthcare? Did they work in the industry before becoming a VC? Are you just another portfolio company, or do they have real conviction?

Brand helps with future fundraising, but day-to-day, it's about the individual relationship.

TRANSFORMING HEALTHCARE FROM "NECESSARY EVIL" TO LOVE

OM: Looking ahead, what gets you most excited about where healthcare is heading in Brazil?

VA: We're proving things that were just theory before. People who exercise cost less to insure. AI can predict and prevent fraud. You can deliver higher quality care at lower cost if you align incentives correctly.

But the bigger opportunity is cultural. We're transforming how Brazilians think about health insurance—from a "necessary evil" to something they actually love. One customer told me he wants to "tattoo Sami" because our nurse caught his COVID before he realized he was sick and probably saved his life.

When you participate in the most important moments of someone's life—birth, illness, death—and you do it well, you create relationships that transcend transactions.

WHAT LATAM FOUNDERS GET RIGHT ABOUT HEALTHCARE

→ Start with distribution, not product. The best healthcare solution means nothing if you can't sell it. Master the go-to-market before you perfect the algorithm.

→ Data creates defensibility. Real-world usage data—exercise habits, medical expenses, behavioral patterns—beats survey responses every time. Build systems that capture ground truth.

→ Regional can beat national. Controlling cost and quality is easier with concentrated networks. Going too wide too fast kills margins.

→ AI works best in operational workflows. Don't chase AI-native business models. Use AI to automate underwriting, fraud detection, and administrative tasks that directly impact unit economics.

P.S. If this issue was valuable to you please share it with a founder who needs to hear it. Let’s build LATAM’s next tech leaders—together

🎙 The J Curve is where LATAM's boldest founders & investors come to talk real strategy, opportunity and leadership.