- The J Curve

- Posts

- The Best VC Returns Aren’t in Silicon Valley

The Best VC Returns Aren’t in Silicon Valley

Every year, Atlantico’s Latin America Digital Transformation Report becomes the definitive backbone for understanding the state of LatAm tech. Now in its 6th edition, the nearly 200-slide report goes deeper than ever—covering venture returns, geopolitics, Pix’s disruption, AI adoption, and Mexico’s inflection point.

To unpack the 2025 findings, I sat down with Julio Vasconcellos, Partner at Atlantico, Facebook’s first country lead in Brazil, and co-founder of Peixe Urbano. What follows is a wide-ranging conversation on the trends shaping the future of Latin American entrepreneurship and investing — adapted and edited for the J Curve Insider newsletter format.

Let’s get into it.

Brazil vs Mexico: The Playbook for Betting on LatAm’s Giants

YOUR FUND SIZE IS YOUR STRATEGY

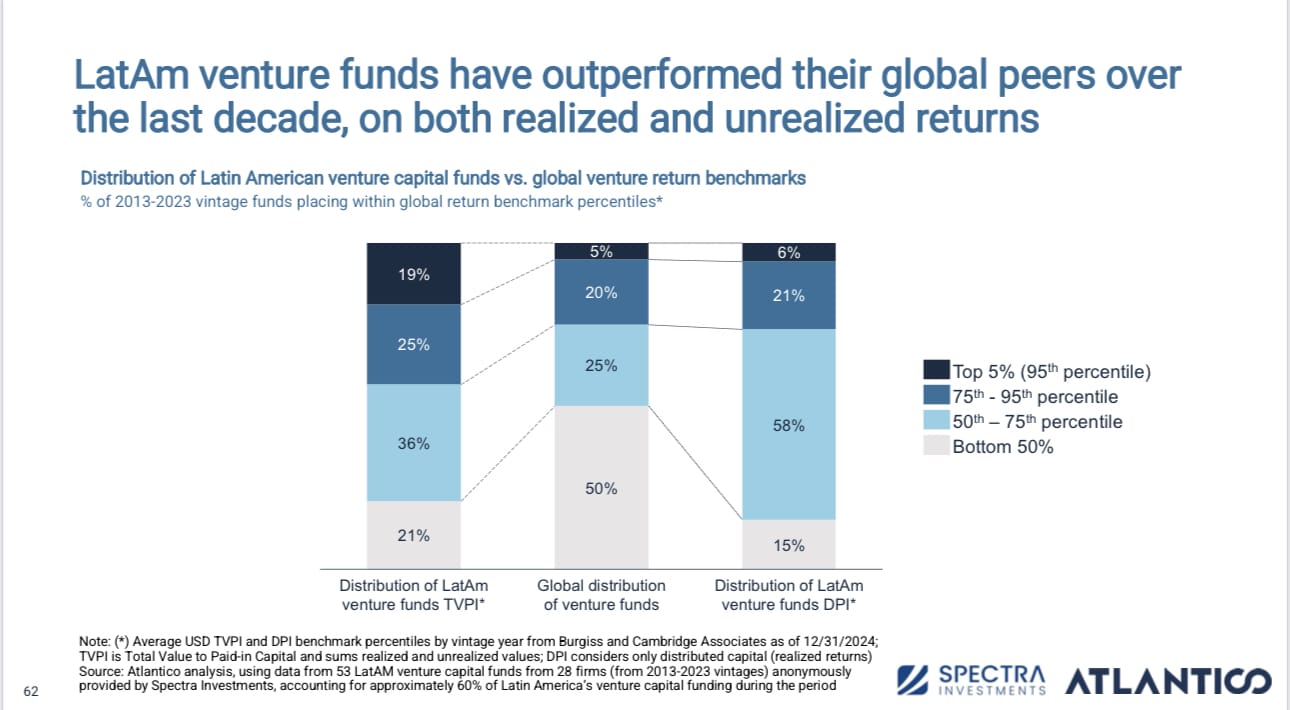

Olga Maslikhova: Julio, let’s start with something that will surprise a lot of people — your data shows Latin American VC funds are four times more likely to land in the global top 5%. How is that possible?

Julio Vasconcellos: There are two big reasons. First, the market structure. For a long time there were very few funds operating here, so the value that got created was concentrated among a handful of players. And second, capital efficiency. Founders in Latin America have always done more with less. We’ve produced more billion-dollar companies than India or Southeast Asia — with only about one-twentieth of the venture capital invested. That’s why nearly 20% of LatAm funds now sit in that global top 5%.

OM: Those returns sound incredible, but global capital is still inconsistent in the region. Why hasn’t that translated into more LP dollars?

JV: Part of it is just scale — the market is smaller than the U.S., so you still get gaps at different stages, like Series B or pre-IPO. But over the last two to three years, things have been a lot more stable. We’ve seen about $1.5 to $2 billion deployed every semester, and right now there’s a record $3 billion in dry powder waiting to go to work. The lesson for LPs is simple: your fund size is your strategy. If you size it right, you can deliver world-class returns, but if you get too large, you outgrow the potential.

A slide from The 2025 Latin America Digital Transformation report

VISA AND MASTERCARD SHOULD BE WORRIED

OM: Let’s talk about Brazil’s payments revolution. Pix adoption has just been relentless — a huge share of the population now uses it daily, and close to 90% of companies already adopted it. What kind of economic impact does that level of adoption actually create?

JV: It’s massive. We estimate Pix has already generated close to $15 billion in savings. Two things drive that. First, it avoids card network fees — merchants here were paying anywhere from 1.5% to 5% in MDR. Second, it eliminates the cost of handling cash, which studies put at around 1% of transaction volume for merchants and up to 3% economy-wide when you include transport, theft, and lost interest. And now what’s fascinating is that B2B Pix usage is outpacing peer-to-peer transfers. That’s really the second wave of adoption.

A slide from The 2025 Latin America Digital Transformation report

OM: How disruptive is this for Visa and Mastercard's strategy in Brazil?

JV: Credit has been more resilient because of the credit element itself, but even that’s eroding now with Pix installments and buy-now-pay-later. The card networks are responding — investing in innovation, building better fintech infrastructure, acquiring startups. Visa’s billion-dollar acquisition of Pismo last year is a great example. But Roberto Campos Neto, the former Central Bank president, was very clear: Pix was designed to come straight at the card issuers.

OM: I personally think global card networks need to rethink their strategy — not just in Brazil, but by using Brazil as a sandbox for innovation. Pix isn’t just a threat to Visa and Mastercard though; we already saw how its launch completely wiped out the first wave of QR-payment startups. So if you’re a founder today, looking at fintech, how should you think about opportunities given Pix’s dominance?

JV: The real opportunity isn’t just Pix, or just AI, or just blockchain — it’s what happens when you start combining them. That’s where the second- and third-order effects come in. As an investor, my role isn’t to predict the future, but to recognize it when a founder walks through the door with a business model that creatively brings these technologies together to solve real problems.

MEXICO IS NOT BRAZIL — AND THAT’S THE OPPORTUNITY

OM: Let’s talk about Mexico. It has a much bigger spotlight in this year’s report. Why now?

JV: Historically, Mexico struggled on two fronts — supply and demand. On the supply side, access to cheap capital was limited. Their debt markets just aren’t as deep or as liquid as Brazil’s FIDCs. On the demand side, consumer behavior was the barrier: more than 50% of transactions were still done in cash, compared to Brazil where payments are almost entirely digital.

But both of those gaps are finally starting to close. Fintechs are now getting full banking licenses, so they can use deposits as a funding base. And players like Nubank and Mercado Pago are spending heavily to educate consumers about digital accounts, showing people not just how to transact digitally but also how to earn yield instead of leaving money under the mattress.

A slide from The 2025 Latin America Digital Transformation report

OM: Who’s managed to crack the code in Mexico, and how?

JV: Plata is one of the most interesting examples. It was started by former Tinkoff Bank employees from Russia, and they’ve taken a completely offline approach in Mexico. Every new customer has their credit card hand-delivered by a company ambassador, in a premium box. The ambassador does in-person KYC, activates the card, spends about ten minutes explaining how to use it, and even asks for referrals. It feels counterintuitive in a world that’s all about “digital-first,” but in Mexico, this manual onboarding has been incredibly effective for building trust and retention. Today, they’re nearing two million active cards with almost a thousand ambassadors on the ground.

Another example is Ximple. They’re using multi-level marketing networks — the same people who sell Avon or Natura products — to extend credit within their communities. These sellers handle everything: underwriting, disbursement, even collections. Again, it’s very hands-on, but it works in markets where people need that human layer of education and trust to adopt financial services.

OM: So if you’re an investor, how should you think about Mexico versus Brazil?

JV: The key filter is: how big can a player get in each market? Brazil’s financial system is larger, so naturally the upside is bigger. For a Mexican fintech to reach the same scale, it has to capture a disproportionate share of its market. But here’s the flip side: Mexico’s friction actually creates powerful moats. Getting the right licenses, building your own infrastructure, solving funding — those are huge barriers to entry. And once you’ve overcome them, they compound into massive competitive advantages. That’s why I think Mexico will lean more toward winner-take-most dynamics, while Brazil will continue to have multiple winners in each category.

FORGET IDEOLOGY: BRAZIL IS CHOOSING PRAGMATISM

OM: Let’s shift gears to geopolitics. One of the data points that really stood out in this year’s report is that almost 40% of Brazilians said they’d align with China over the U.S. in a trade dispute. That feels counterintuitive given the historic influence of the U.S. in the region. What’s behind that?

JV: It surprised me too. First, a qualifier — in our survey a statistically equal number of Brazilians actually said “both.” But the bigger story is that Latin Americans, both Brazilians and Mexicans, overwhelmingly see China as an opportunity rather than a threat. That’s very different from Americans, who tend to view China as a rival. Here, people see China as Brazil’s number one trading partner — the country that buys our exports and sells us cheaper goods.

A slide from The 2025 Latin America Digital Transformation report

The second factor is investment. As it’s become harder for Chinese companies to expand in the U.S. or Europe, they’ve doubled down in Latin America — not just in tech but in infrastructure and energy. You can see it in daily life: the entire EV charging network in Brazil is owned by Chinese companies. In São Paulo, when you order an Uber, there’s a good chance it’s a BYD — the same way you’d get a Tesla in New York.

And then there’s the role of the U.S. itself. Recent tariff disputes and trade tensions have made people here feel the U.S. isn’t always the most reliable partner. That nudges sentiment a bit closer toward China.

So the big takeaway is that Latin America is pragmatic. The region doesn’t look at China ideologically. It sees a huge economy, a source of investment, jobs, and infrastructure.

WHAT AI MEANS FOR BRAZIL’S FOUNDERS AND INVESTORS

OM: Brazil now ranks as one of the top three markets globally for ChatGPT usage. How should we think about AI’s broader economic impact here?

JV: The numbers are striking. Brazilians spend about 9.2 hours online every day compared to around 7 in the U.S., and more than 50 million people here use ChatGPT every month. What’s exciting is how AI acts as a great equalizer for productivity. Brazil has historically lagged developed economies when it comes to productivity growth, but AI democratizes access to expertise — whether it’s a tutor, a doctor, a lawyer, or a consultant.

And it’s not just consumers. Businesses can suddenly be better, faster, and cheaper with these tools. Take CloudWalk as an example. As a third-generation payments company, it’s generating four times the revenue per employee compared to legacy players like Cielo, and twice as much as second-generation companies like Stone. That’s the AI effect in action.

A slide from The 2025 Latin America Digital Transformation report

OM: And then there’s Microsoft’s announcement — a $2.7 billion investment in AI infrastructure here in Brazil. What does that mean to you?

JV: It’s a big deal. The energy requirements for AI are projected to grow by about 3.5x between 2025 and 2030. Brazil has an edge: abundant cheap and clean energy, access to water, and a regulatory environment that’s increasingly supportive. The government is also layering in tax and fiscal incentives to attract more infrastructure buildouts. Put it all together, and Brazil isn’t just going to be a fast adopter of AI applications — it’s well-positioned to become one of the global leaders in AI infrastructure.

URGENCY, OPTIMISM, AND A CHIP ON THE SHOULDER

OM: You’ve mapped founder archetypes using AI. What stood out about successful Latin American founders?

JV: We interviewed 100 CEO founders and used multimodal AI to analyze not just what they said, but how they said it — their charisma, energy, and communication style. Interestingly, we didn’t find major differences compared to U.S. founders. Being a founder seems to be a universal personality type.

But when we compared them to the general population, the contrasts were clear. Successful founders showed a much higher sense of urgency and less patience. They often had something to prove — that “chip on the shoulder” mentality. And they were far more optimistic, which makes sense: you have to be a little irrationally positive to start a company. The most surprising finding was that the best-performing founders consistently over-indexed on emotional intelligence.

Julio Vasconcellos at our Studio in Sao Paulo

RAPID FIRE

OM: If you had to bet, which of this year’s findings will look most obvious in hindsight five years from now, but feels underappreciated today?

JV: That 2025 is the true inflection point for Mexico’s fintech ecosystem — the year supply and demand gaps finally close and the market takes off.

OM: What infrastructure gaps still stand out as the biggest blockers for scale in the region?

JV: Talent. AI engineers are by far the scarcest resource, and without that specialized skill set, scaling becomes very difficult.

OM: Which LatAm country outside of Brazil and Mexico do you think is the most underrated right now?

JV: Argentina. The talent is exceptional, MercadoLibre alumni created a strong ecosystem, and founders there are forced to think globally from day one.

OM: What’s one founder behavior or mindset you see in Latin America that gives the region a real edge globally?

JV: Resilience. Founders here have learned to do more with less and to survive deeper ups and downs than most places in the world.

OM: What’s the single biggest misconception global investors still have about Latin America?

JV: That you can’t make money here. In reality, founders, VCs, and LPs have often made more here than in other parts of the world.

OM: Looking ahead, which global trend — AI, climate, or deglobalization — will most reshape LatAm’s tech landscape over the next decade?

JV: AI. It’s the great equalizer and will reshape productivity, company scale, and LatAm’s global reach.

OM: Which LatAm tech success story do you think is still underappreciated globally?

JV: iFood. It’s a financial monster and an amazing company that deserves more global recognition.

OM: What’s one data point from this year’s report you wish every founder in the region would memorize?

JV: That successful founders consistently over-index on emotional intelligence. Being more in touch with feelings and emotions was the clearest differentiator.

OM: If you had to pick one sector where the next $10B company in LatAm will emerge, which would it be?

JV: Healthcare. It’s massive, full of inefficiencies, and ripe for disruption.

OM: And finally, if you had to describe Latin America’s digital transformation in one word?

JV: Exponential. Every curve is up and to the right, and the compounding effects are just beginning.

Julio and I at our studio in Sao Paulo

THE J CURVE HALL OF FAME

Since we’ve been talking Brazil, China, and geopolitics — here’s my first deep dive into the business side of China in Brazil. It sparked a lot of reactions after release, hope you’ll enjoy the read too.

And if the report didn’t make it clear enough that Brazil leads in fintech innovation — João’s story at EBANX does: turning Brazil’s regulatory and payment complexity into a competitive moat and scaling it into one of Advent International’s largest-ever tech deals:

The Case for Building Global from Day One

Thanks for reading,

Olga

P.S. If this issue was valuable to you please share it with a founder who needs to hear it. Let’s build LATAM’s next tech leaders—together

🎙 The J Curve is where LATAM's boldest founders & investors come to talk real strategy, opportunity and leadership.